Car title loans Lockhart TX provide quick cash for borrowers with little to no credit history, secured by their vehicle's equity. While offering lower interest rates and flexible terms compared to traditional banking, these loans have shorter repayment periods and carry the risk of repossession if not managed responsibly. Weighing alternatives like personal loans or property-backed options is crucial before pursuing car title loans Lockhart TX.

Considering a car title loan in Lockhart, Texas? This guide explores whether it’s the right move for your financial needs. We break down ‘car title loans Lockhart TX’, offering insights into their mechanics and implications. From understanding the process to weighing pros and cons against alternatives, this resource ensures you make an informed decision about short-term financing options.

- Understanding Car Title Loans in Lockhart TX

- Pros and Cons of Using Car Title Loans

- Alternatives to Lockhart TX Car Title Loans

Understanding Car Title Loans in Lockhart TX

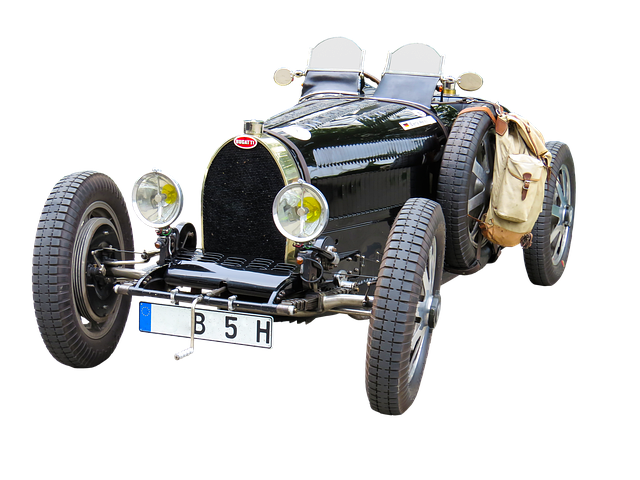

Car title loans Lockhart TX have gained popularity as a quick solution for borrowers in need of cash. This type of loan is secured by the borrower’s vehicle, which serves as collateral. When you apply for a car title loan, the lender will assess your vehicle’s value and offer a loan amount based on that appraisal. Unlike traditional loans that require extensive credit checks, car title loans focus more on the vehicle’s equity rather than the borrower’s credit history. This makes them an attractive option for individuals with less-than-perfect credit or no credit at all.

The process typically involves providing proof of ownership and a valid driver’s license. Lenders will then conduct a quick assessment of your vehicle, after which they can approve your loan request promptly. One key advantage of car title loans Lockhart TX is the flexibility in repayment terms. Borrowers can choose a repayment schedule that aligns with their financial capabilities, making it easier to manage their debt. Moreover, compared to other short-term lending options like Dallas title loans, car title loans often have lower interest rates, making them a more cost-effective choice for those needing immediate financial assistance.

Pros and Cons of Using Car Title Loans

Car title loans Lockhart TX can be a quick and accessible solution for those seeking emergency funding. One significant advantage is the ease of approval; unlike traditional bank loans, these loans often have looser credit requirements, making them available to a broader range of borrowers. Additionally, the process is streamlined, allowing you to receive funds faster compared to other loan types. Borrowing against your vehicle’s title as collateral means lenders are more willing to offer competitive interest rates and flexible repayment terms, potentially saving you money in the long run. This option can be particularly beneficial for Fort Worth loans when managed responsibly, helping you maintain your financial stability while meeting urgent needs.

However, there are potential drawbacks to consider. Car title loans typically have shorter repayment periods, which may not suit everyone’s financial capabilities. If you’re unable to repay on time, it could lead to additional fees and even the risk of repossession of your vehicle. Furthermore, these loans often come with higher interest rates than unsecured personal loans, meaning you’ll pay more in interest over the life of the loan. It’s crucial to understand that using your vehicle as collateral could impact its value if you default on the loan, making it harder to sell or trade-in later. Always weigh these pros and cons carefully before deciding whether a car title loan is the right choice for your situation, ensuring informed decision-making regarding Fort Worth loans.

Alternatives to Lockhart TX Car Title Loans

When considering a Car Title Loan in Lockhart TX, it’s crucial to explore alternatives that offer better terms and conditions. While car title loans are designed as quick cash solutions, they often come with high-interest rates and stringent requirements, such as no credit check, which can put borrowers at risk. This type of loan uses your vehicle as collateral, meaning if you fail to repay, the lender has the right to repossess your car.

Several other options are available for those in need of emergency funding. Personal loans from banks or credit unions typically offer more favorable interest rates and longer repayment terms, though they may require a good credit history. Additionally, peer-to-peer lending platforms connect borrowers directly with lenders, potentially resulting in more flexible terms. For those with assets, considering a home equity loan or line of credit could be another viable alternative, providing larger sums secured by your property.

When considering financial options, it’s vital to weigh the pros and cons of car title loans in Lockhart TX. While these short-term solutions can provide quick cash, they come with risks such as high-interest rates and potential vehicle repossession. Exploring alternatives like personal loans or building credit through responsible spending may be more sustainable in the long run. Before you decide, thoroughly research local regulations governing car title loans in Lockhart TX to ensure fairness and protection.