Car title loans Lockhart TX offer short-term secured funding using a vehicle's title as collateral. With an easy online application and quick approval, these loans provide immediate financial assistance. Loan amounts are determined by vehicle value, typically 15-30 days long. Borrowers in Lockhart benefit from clear terms, accurate valuations, dispute resolution, and Texas law protections. To avoid predatory practices, borrowers should thoroughly understand loan conditions, compare rates, and prioritize financial stability alongside quick cash access.

In the fast-paced world of finance, car title loans have emerged as a quick solution for short-term funding. For borrowers in Lockhart, TX, understanding this process and knowing their rights is crucial. This article delves into the intricacies of car title loans in Lockhart TX, highlighting borrower protections and safe practices to navigate this type of lending. By exploring these key aspects, you’ll gain valuable insights into ensuring a positive loan experience.

- Understanding Car Title Loans Lockhart TX

- Borrower Rights and Protections in Texas

- Avoiding Common Pitfalls: Safe Loan Practices

Understanding Car Title Loans Lockhart TX

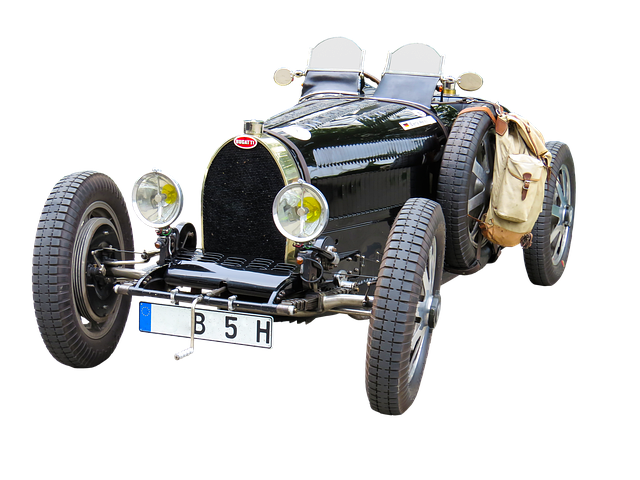

Car title loans Lockhart TX are a type of secured loan where borrowers use their vehicle’s title as collateral. This means that the lender has the right to take possession of the vehicle if the borrower fails to repay the loan according to the agreed-upon terms. Such loans are typically short-term, ranging from 15 to 30 days, and offer a relatively small loan amount, usually based on the value of the vehicle. This option is often sought by individuals needing quick financial assistance for unexpected expenses or emergencies.

In Lockhart TX, as in many other places, these loans are popular due to their ease of access and fast approval process. Applicants can apply online, providing details about their vehicle and personal information. The lender will then assess the vehicle’s value and determine loan eligibility. This entire procedure can be completed swiftly, offering a convenient solution for those requiring immediate financial support.

Borrower Rights and Protections in Texas

In Texas, borrowers seeking car title loans Lockhart TX often look for security and clarity amidst the financial decision-making process. The state offers several protections to safeguard these borrowers. One key right is the ability to repay the loan over time, rather than in a single bulking payment, which helps manage cash flow. Additionally, lenders are required to disclose all terms and conditions clearly, ensuring borrowers understand their obligations. This transparency includes detailing interest rates, fees, and the potential consequences of defaulting on the loan.

Another crucial protection is the process of vehicle valuation, where borrowers can assess the accuracy of the title pawn value assigned to their vehicle. This step empowers them to make informed decisions about the loan amount and terms. Furthermore, Texas law provides avenues for dispute resolution, allowing borrowers to challenge any inaccurate or unfair practices, ensuring a fair deal through quick funding mechanisms like car title loans Lockhart TX.

Avoiding Common Pitfalls: Safe Loan Practices

When considering a Car Title Loan Lockhart TX, borrowers must be vigilant to avoid common pitfalls that often arise with such secured loans. These loans use your vehicle’s title as collateral, making them appealing for their simplicity and fast approval times. However, it’s crucial to understand the terms and conditions thoroughly. Many lenders in San Antonio offer these loans, but not all practices are ethical or transparent.

To safeguard yourself, always ensure you meet the loan requirements set by reputable lenders. This includes verifying the lender’s legitimacy, comparing interest rates, understanding repayment terms, and knowing your rights under Texas law. Unlike unsecured loans, car title loans come with significant risks if you default, as it can lead to repossession of your vehicle. Practicing safe loaning habits means being informed, responsible, and prioritizing your financial well-being alongside the convenience of a quick cash solution.

When considering a car title loan in Lockhart, TX, understanding your rights and protections is crucial. By familiarizing yourself with borrower rights, practicing safe loan habits, and avoiding common pitfalls, you can make an informed decision that best serves your financial needs. Remember that knowledge is power when it comes to securing the most favorable terms for a car title loan in Lockhart, TX.